Confidential's property roundup comes via Adam Robson, Director at AKM Property Consultants

Renaker have submitted their latest application for over 1,400 units across four Ian Simpson-designed towers, ranging from 38 to 64 storeys

WITH the New Year long behind us many people have taken up drinking again, still, there was no January dry spell for Manchester's property market.

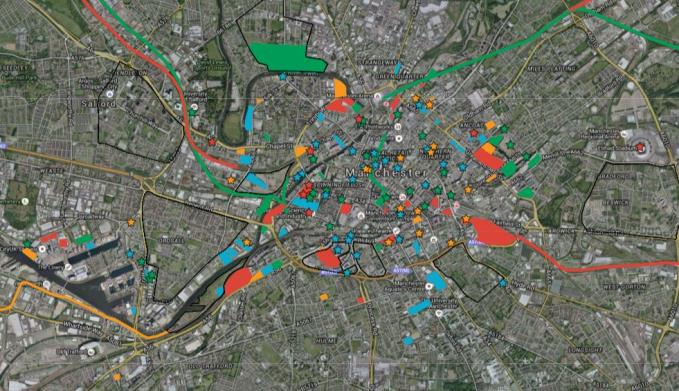

All those interested in the development of Manchester should take a look at the work of a keen student by the name of Ed Howe who has created an interactive online map showing all the key schemes planned and in development across the city.

Proposed and underway developments across Manchester and Salford (credit: Ed Howe)

Proposed and underway developments across Manchester and Salford (credit: Ed Howe)

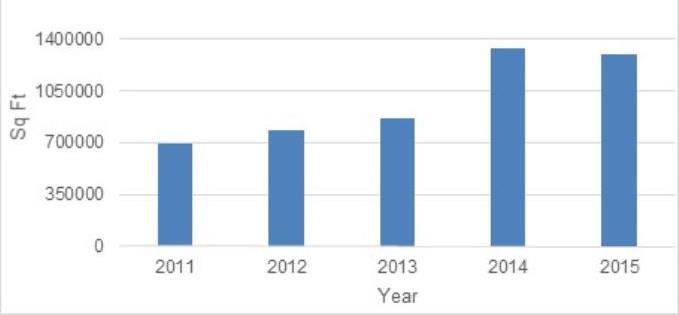

Office take-up figures for 2015 by the Manchester Office Agents Forum (MOAF) have revealed that 1.3 million sq ft were transacted in the city centre, which although not managing to surpass that of 2014, was still a very strong year for the city, standing only 15,000 sq ft below 2001’s record take up.

There was significant pre-let activity accounting for over 250,000 sq ft including key deals such as: 1 Spinningfields, PWC 49,406 sq ft; Two St Peters Square, EY 41,628 sq ft; XYZ, Global Radio 16,669 sq ft, Shoosmiths 32,000 sq ft, NCC Group 60,000 sq ft.

City centre office take-up

City centre office take-up

The year began with a bang following two key transaction announcements, the first being Addleshaw Goddard’s 56,000 sq ft acquisition at One St Peter’s Square, the other being Allied London’s 27,500 sq ft letting to Squire Patton Boggs who will join PWC in calling No.1 Spinningfields home. Chris Reay, Spinningfields Estate Director at Allied London, said:

"Squire Patton Boggs is a global business with a clear ambition in Manchester. Only No.1 Spinningfields could accommodate their requirements, being the highest specification building outside of London and offering the unrivalled environment of Spinningfields.”

No.1 Spinningfields

No.1 SpinningfieldsWith demand clearly outstripping supply for existing Grade A offices, it comes as no surprise that headline rents are set to grow, with Colliers predicting that rents will reach £35 per sq ft by mid-2016 and £40 per sq ft by 2018. Current headline rents sit around £34 per sq ft, most recently demonstrated by the letting to Colliers at The Chancery at 58 Spring Gardens.

The chaps over at Property Alliance Group were busy last month putting in a planning application for an additional floor on 55 Portland Street as part of an overall refurbishment of the tired office buildings including plans for a new 4* Park Plaza and casino to be added to the side of the building. Planners are reported to have recommended its approval despite objections from Manchester’s Conservation Panel who thought it better to knock down the existing building and start again.

55 Portland Street

55 Portland StreetProperty Alliance are also reported to be in the process of buying the 300,000 sq ft 3 and 4 Piccadilly Place from Carlyle in a joint venture with Ares Management for an estimated £117 million, showing a strong return of £27 million for Carlyle having bought the buildings from Argent in 2007.

The sale of Piccadilly Place marks a great start to 2016 for the investment market with a number of other buildings trading hands, including: the £5.6 million sale of 101 Princess Street; HIMOR’s sale of Clarence House for £6.94 million to CBRE Global Investors; Helical Bar’s purchase of Fountain Court for an undisclosed figure; and Patrizia’s sale of the 208 room Innside at First Street for £30.45 million, which represented a yield of 4.85%.

Rob Brook, Head of Portfolio Management at Patrizia, said: “With our asset management activities complete at the hotel, this is the first sale we have undertaken at First Street and now means we can recycle our balance sheet in new development management initiatives being pursued by Patrizia.”

Mr. Brook appears to be a man of his word with Patrizia revealing plans for a 26-storey 624 unit PRS scheme at First Street. In addition they have also announced a joint venture with GMPVF for the development of the first new office building at First Street which will extend to 173,600 sq ft of which 39,750 sq ft has been pre-let to Gazprom.

Patrizia's 624 unit First Street scheme

Patrizia's 624 unit First Street schemeAsk have also had a good start to the year following the news that Carillion have purchased a majority stake in the business following an existing relationship with Ask and Tristan Capital Partners at Embankment. Following the announcement, Ask revealed that they plan to create a £500 million pipeline of commercial property development schemes in the North with managing director John Hughes saying:

"The Carillion investment into Ask Real Estate is a game changer for the business, presenting us with an exciting opportunity to marry our reputation for delivering high quality developments and spaces in urban centres with the expertise and financial resource of Carillion."

Ask submitted a planning application with Select Property Group for 694 apartments at Greengate's Embankment West within a matter of weeks of the announcement so expect more news on their development progress throughout 2016.

Embankment West

Embankment WestAppetite for residential development shows no sign of slowing down. Glenbrook have submitted plans for 232 PRS flats on the site of the former Shepherd Gilmour offices on Ellesmere Street having completed Queens Dock in Liverpool.

Renaker have submitted their latest application for over 1,400 units across four Ian Simpson-designed towers, ranging from 38 to 64 storeys (17 storeys higher than the Beetham) at the former West Properties site at Owen Street which, if approved, could mean the developer is onsite by the third quarter of the year - more here.

Owen Street

Owen StreetAnother former West site has also been granted a new lease of life with planning permission being granted to Urban & Civic for the development of the former Origin site at Whitworth Street and Princess Street where 238 apartments and a 148 bed hotel will be delivered. Now the only property left from the West legacy to see some traction is the Renaissance hotel, which Urban & Civic have also acquired, but it can only be a matter of time until the old plans are dusted down and freshened up.

Over to Salford Quays now where TH Real Estate have submitted a proposal for the redevelopment of Waterfront Quays. A previously neglected low rise office development could now see it be transformed from a white elephant 1980’s office scheme into a bustling residential scheme with plans for 800 apartments across Pier 7.

Waterfront Quays

Waterfront QuaysElsewhere, Manchester City Council has given the go-ahead to the £60m Graphene Engineering Innovation Centre (GEIC) – a new two-acre state-of-the-art University of Manchester facility aimed to accelerate the transition of graphene from the lab to the marketplace.

The centre is to be located on Oxford Road by the Mancunian Way and has been designed by world-renowned New York-based ‘starchitect’ Rafael Viñoly – the man behind Man City’s new £200m football academy, London’s controversial ‘Walkie Talkie’ building and a much-publicized new circular bridge in Uruguay.

GEIC

GEICMeanwhile, six developers, including Argent, Ask with Patrizia, Muse and Urban & Civic, have been shortlisted to bring forward the proposed £550m 24-acre Mayfield Quarter scheme (main image) over by Piccadilly Station after the Mayfield Partnership, consisting of the City Council, London & Continental Railways and TfGM, began searching for a development partner late last year. According to the Mayfield Partnership, the new quarter could provide around 800,000sq ft of office space, together with 1,300 homes, a 350-bedroom hotel, retail and leisure facilities and a new six acre city park centred along a remediated River Medlock'.

See you in a month.