IT happens with sickening regularity: The pensioner next door handing over their life savings - in overseas moneygrams - to the cold caller telling them they've won the Nigerian lottery.

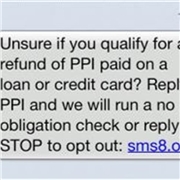

The constant texts and mystery recorded messages insisting that we are eligible for compo for the road accident we had in 2003. Except we didn't have an accident in 2003. Alternatively, we are owed tens of thousands of pounds in PPI.

Month

Scams are everywhere, modern technology has allowed them to go global and it's hard not to get suckered in, sucker.

Now Liverpool people are being warned to be on the look-out for smarmy callers offering financial services but who will leave them out of pocket.

Spot the signs: Speke and Wavertree CABs are leading the initiative

Spot the signs: Speke and Wavertree CABs are leading the initiative

Liverpool Trading Standards and both Speke and Wavertree Citizen’s Advice Bureaux have teamed up to run Scams Awareness Month throughout May.

They are urging people to “spot scams to stop scams”.

In particular they are warning people to be wary of unsolicited phone calls or texts offering financial services such as PPI claims, loans or debt reduction services.

You might know all this, but it may be worth hearing again.

Upfront

John McHale, of Liverpool Trading Standards, said: “This month we are warning people to be on the look out for rogues looking to make a quick buck at their expense and reminding them that scams are crimes so it is vital they are reported.

Trading Standards has seen an increase in complaints from consumers who have responded to these types of calls and found themselves out of pocket. Many of the calls ask for upfront payments, often by electronic money, and then provide no service to the consumer who has little chance of getting their cash back.

Eileen Devaney manager of Speke CAB said: “People are seeing their money go down the drain as con artists rip them off by promising loans, debt management, refund of PPI or bank charges, lottery wins, or even a new job only to find there is nothing at the end. In these difficult economic times to lose money over something like this can be devastating for many people.”

As part of Scams Awareness Month both Speke and Wavertree CAB’s will be running open events for the public at Allerton and Picton libraries in May.

On the fiddle: how to avoid being burned

Signs of a scam-

The call, letter, e-mail or text has come out of the blue.

-

You’ve never heard of the lottery or competition they are talking about.

-

You didn’t buy a ticket – so you can’t win.

-

They are asking you to send money in advance.

-

They are saying you have to respond quickly, so you don’t get time to think about it or ask family and friends before you decide.

-

They are telling you to keep it a secret.

-

They seem to be offering you something for nothing.

-

If it seems too good to be true – it probably is.

How to protect yourself better

-

Never give out contact details like your name, phone number or address to strangers or to people who should have this information already.

-

Never give financial information or details of your identity, bank accounts or credit card to strangers or to the businesses that should already hold your details.

-

Shred anything with your personal or bank details on – don’t just throw it away.

-

If in doubt, don’t reply. Bin it, delete it or hang up.

-

Persuasive sales patter? Just say: “No Thank You.”

-

Resist pressure to make a decision straight away.

-

Never send money to someone you don’t know.

-

Walk away from job adverts that ask for money in advance.

-

Ask friends, neighbours or family about whether an offer is likely to be a scam.

Common scams

Lotteries — A phone call, text or email proclaims a huge lottery win – even though the receiver hasn’t bought a ticket. In order to collect winnings you are asked to send money to cover “processing” or “administration” costs.

Phishing — an email (or Vishing for phone calls) pretending to be from your bank asking for you to update, validate or confirm details so that scammers can access your account.

SMShing - mobile phone text messages lure you onto fraudulent websites or invite you to call a premium rate mobile number or download malicious content via the phone or web.

Electricity meter credit – people on pre-payment meters are offered cut-price electricity but end up paying for their energy twice. Criminals use cloned keys to top up energy credit illegally. You end up paying for the energy twice – first to the fraudsters and then to the company at the correct rate.

Pyramid selling — This is an illegal trick where you are told you can earn money by recruiting new members to a money-making venture. In reality only a tiny minority make money, everyone else loses.